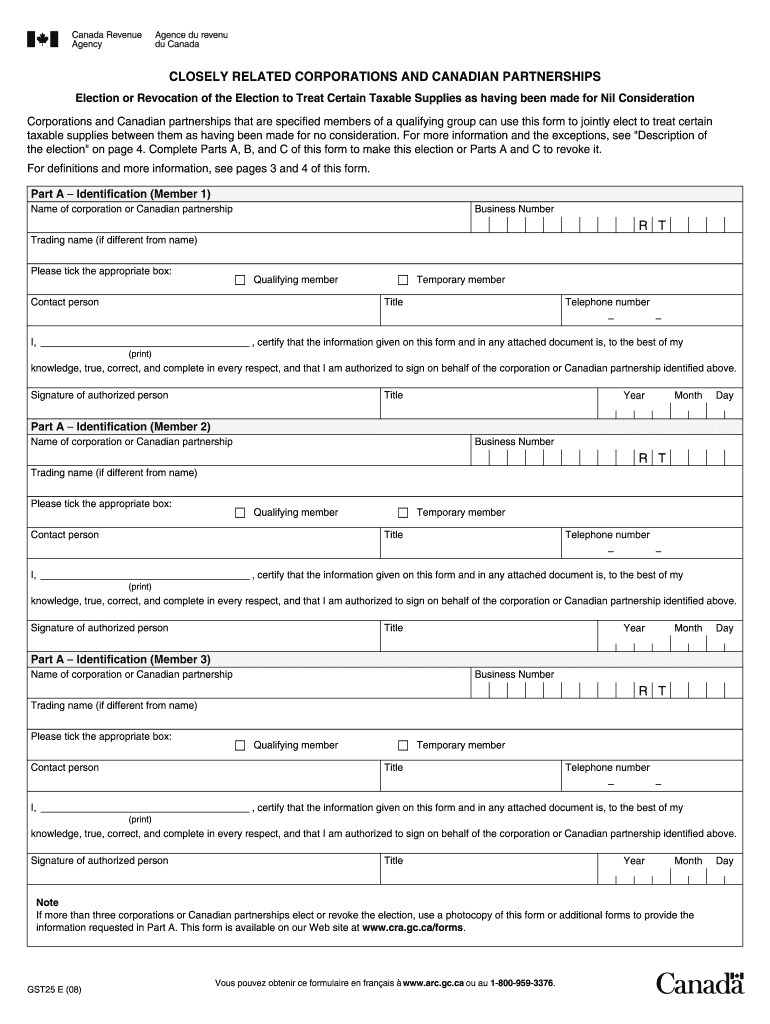

What is GST25 Form?

GST25 Form refers to the closely related corporations and Canadian partnerships. This form must be used by the Canadian partnerships and other organizations that are the qualifying group members subject to tax withholding.

What is GST25 Form for?

All Canadian partnerships and corporations must use this form for election or revocation of the election for treatment of certain taxable supplies according to Nil Consideration. To know more about the form check the description of the election or the instructions.

When is GST25 Form Due?

This form may be completed on the annual or quarterly basis depending on the type of partnership or organization.

Is GST25 Form Accompanied by Other Documents?

Generally this form may be filed without any attachments. You may be required to provide additional documents if such necessity occurs.

What Information do I Include in GST25 Form?

The form has three sections. The first Section A is devoted to the identification of the members. There are the blocks for three members. Provide the following information in this part: name of partnership or corporation, business number, trading name, contact person (name, title and telephone), membership type (qualifying or temporary), signature of the authorized person with the date and title. Section B is called the Eligibility for the Election and is divided into two sections. And the last section is aimed at the election or revocation of the election.

Where do I Send GST25 Form?

This form must be sent to the Revenue Agency of Canada.